Two weeks ago I argued that a Federal Reserve decision to raise rates in September would be a serious mistake. As I wrote my column, the market was assigning a 50 percent chance to a rate hike. The current chance is 34 percent. Having followed the debate among economists, Fed governors and bank presidents I believe the case against a rate increase has become somewhat more compelling even than it looked two weeks ago.

Five points are salient.

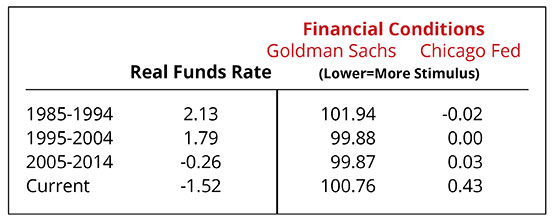

First, markets have already done the work of tightening. The U.S. stock market is worth $700 billion less than it was 2 weeks ago and credit spreads have widened noticeably. Financial conditions as measured by Goldman Sachs or the Chicago Fed index have tightened in the last 2 weeks by the impact equivalent of more than a 25 BP tightening. So even if resisting inflation required a 25 BP tightening as of two weeks ago, this is no longer the case.

The figure below makes a crucial point. It shows that even though the federal funds rate is very low (negative one and a half percent after adjusting for inflation), financial conditions are helping the economy less than in previous years when interest rates were much higher.

Second, the data flow suggests a slowing in the U.S. and global economies and reduced inflationary pressures. Employment growth appears to have slowed down, commodity prices have fallen further, and the general data flow has been on the soft side. Comprehensive measures of data surprises, such as the Bloomberg Economic Surprise Index, bear out this impression and the Atlanta Fed’s GDP Now model is currently predicting only 1.5% growth in Q3.

Third, the case for concern about inflation breaking out is very weak. Market based expectations suggest that inflation over the next decade on the Fed’s preferred core pce basis is near record lows and well below 2 percent. The observation that 5 year inflation, 5 years from now is expected to be below target calls into question arguments that current low inflation is somehow transitory.

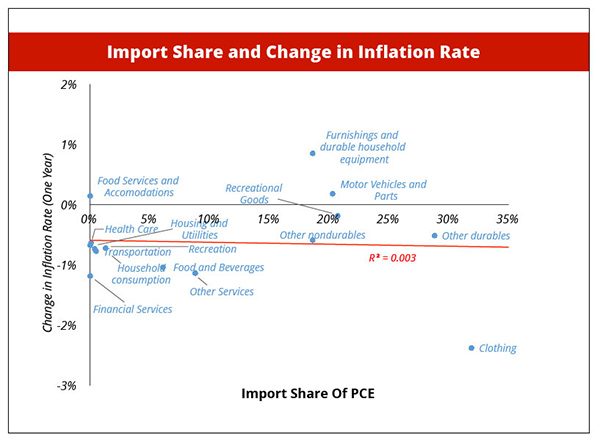

The recent analysis presented by Fed Vice Chair Stanley Fischer asserting to the contrary relies on assumptions about exchange rates and inflation. When actual empirical estimates are used his conclusions are substantially weakened. Indeed as the figure below shows, there is no correlation of late between deceleration in inflation and import share looking across PCE components.

Also on inflation, it bears emphasis that (i) we have some room for inflation acceleration (ii) prices are now fully 2 percent below a 2 percent inflation path taking off from 2010, (iii) the Phillips curve is so unstable that it provides little basis for predicting inflation acceleration. To take just two examples — first, unemployment among college graduates is 2.5 percent yet there is no evidence that their wages are accelerating. And unemployment in Nebraska has been below 4 percent for the last 3 years and growth in average hourly earnings has been basically constant at the national average level.

Fourth, arguments of the “one and done” variety or arguments that the Fed can safely raise rates by 25 BP as long as it’s clear that there is no commitment to a series of hikes are specious. If as some suggest a 25 BP increase won’t affect the economy much at all, what is the case for an increase? And when the same people argue that 25 BP will have little impact and that it is vital to get off the zero rate floor, my head spins a bit.

In a highly uncertain world, the Fed cannot be both data dependent and predictable with respect to its future actions. Much better that it stick with data dependence than that it put its credibility at risk by seeking to mitigate a current rash action by trying to reassure with respect to future steps.

I understand the argument that zero rates are a sign of pathology and the economy is no longer diseased so policymakers have to increase rates. The problem is that the case for hitting the brakes in an economy with sub-target inflation, employment and output is not there; regardless of whether the brakes are to going to be pressed hard or softly, singly or multiple times.

From the Vietnam War to the Euro crisis, from the Iraq war to the lessons of the Depression we surely should learn that policymakers who elevate credibility over responding to clear realities make grave errors. The best way the Fed can maintain and enhance its credibility is to support a fully employed American economy achieving its inflation target with stable financial conditions. The greatest damage it could do to its credibility would be to embrace central banking shibboleth disconnected from current economic reality.

Fifth, I believe that conventional wisdom substantially underestimates the risks in the current moment. It bears emphasis that not a single post war recession was a predicted a year in advance by the Fed, the Federal government, the IMF or a consensus of forecasters. Most were not recognized till long after they started. And if history teaches anything it is that financial interconnections are pervasive and not apparent till it’s too late. Russia’s 1998 default, problems in subprime lending, and the Asian financial crisis were all moments when financial dislocations had far more pervasive effects than was generally expected.

We know that the world’s largest economy, China, is in its most uncertain state since it began economic reform in 1979 and may well be experiencing a larger volume of capital flight than any economy in history. We know that the central banks of Japan and Europe are likely to have to double down in the months ahead on already extraordinary quantitative easing. We know that American households, firms and markets are processing what appears to a kind of “reverse 1990s” moment of sharply decelerating productivity growth. We know that liquidity conditions in markets have worsened and there is at least some reason to believe that “positive feedback” trading strategies where investors sell when prices go down may well have become increasingly important. We know the current U.S. recovery is in its 7th year and that confidence in public institutions is at a low ebb.

More likely than not, these fears are overblown and 2015 and 2016 will not go down in financial history. If so, and the Fed does not act, inflation will start to accelerate, volatility will subside and policy can step in. Regret may come in the form of inflation a few tens of basis points too high or a bit of euphoric relief in markets. If on the other hand, some portion of these fears are warranted and the Fed tips towards tightening, it risks catastrophic error.

Now is the time for the Fed to do what is often hardest for policymakers. Stand still.

September 9, 2015

Pingback: Phillip’s curve: The economic theory that Janet Yellen is stuck with | Easy Money

Pingback: Is Larry Summers right that the rate hike is premature? - Kekselias