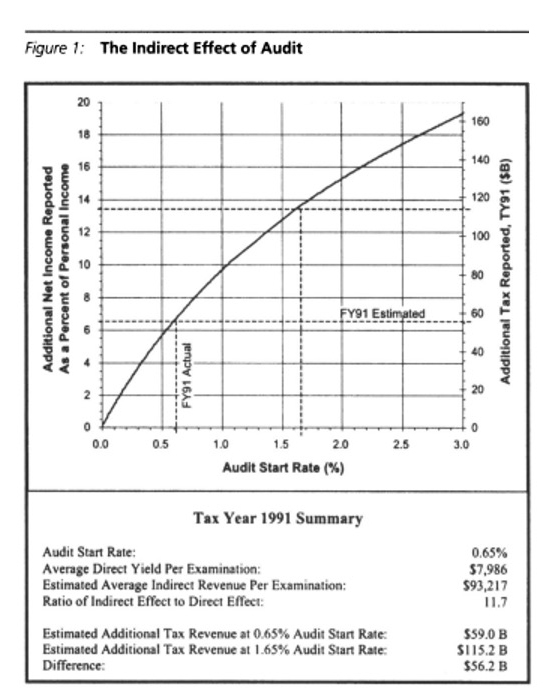

- Early 1996, IRS study compared cross-state differences in audit rates to find the average indirect effect from started audits was about 12 times as large as the direct additional taxes imposed following completed audits that year (Plumley 2002).

- Dubin (2007) relies on IRS examination data for individual filers to conclude that the spillover or indirect effects are at least nine times as large as the direct revenue effects from compliance efforts.

- Hoopes, Mescall, and Pittman (2012) study corporate tax avoidance and find that a doubling of the audit probability increases effective tax rates by 7 percent.

- Alm, Jackson, McKee (2009): Overall, our results yield an estimate of the indirect effect on compliance of 4.4 times the direct effect on compliance, an estimate that falls within the range of estimates from field data.

- Slemrod, Blumenthal, and Christian (2001): Finds although low and middle-income taxpayers substantially increase tax payments if they expect to be audited, reported tax liability for high-income filers actually falls. [direct deterrent effects, our interest is indirect/general deterrence effects]

- DeBacker, Heim, Tran, and Yuskavage (2018) finding that after audits, most individuals become more careful about tax filings, at least in the short-run, but that sophisticated individuals and corporations actually become more aggressive in their misreporting. [direct deterrent effects, our interest is indirect/general deterrence effects]

- DeBacker et al (2018) find that increased income reported in the 5-8 years following a random individual audit is about 1.5 times the revenue generated by the audit itself.

- US Treasury (2019): IRS returns on investment are likely understated because they ignore deterrence effects, which are conservatively estimated to be at least three times the direct revenue effect.

- Boning et al. (2020) find that in-person collection visits raise as much (1) revenue from firms sharing a tax preparer with the visited firm as from the visited firm itself

- Alm (2019): Audits also typically have a ‘spillover’ effect, or an increase in compliance independent of revenues generated directly from the audits themselves, whose magnitude varies from 4 to 12 (e.g., “general deterrence”).

Sources:

Plumley, Alan H. 2002. “The Impact of the IRS on Voluntary Tax Compliance: Preliminary Empirical Results.” In 95th Annual Conference on Taxation. National Tax Association.

DeBacker, Jason, Bradley T. Heim, Anh Tran, and Alexander Yuskavage. 2018. “Once Bitten, Twice Shy? The Lasting Impact of Enforcement on Tax Compliance.” The Journal of Law and Economics 61(1): 1-35.

Dubin, Jeffrey. 2007. “Criminal Investigation Enforcement Activities and Taxpayer Noncompliance.” Public Finance Review 35(4): 500-529.

Hoopes, Jeffrey L., Devan Mescall, and Jeffrey A. Pitman. 2012. “Do IRS Audits Deter Corporate Tax Avoidance?” The Accounting Review 87(5): 1603-1639.

Slemrod, Joel, Marsha Blumenthal, and Charles Christian. 2001. “Taxpayer Response to and Increased Probability of Audit: Evidence from a Controlled Experiment in Minnesota.” Journal of Public Economics 79(3): 455-483.

US Treasury. 2019. “FY 2019 Budget in Brief: Internal Revenue Service, Program Summary by Budget Activity.” US Treasury, Washington, DC.

DeBacker, J., Heim, B.T., Tran, A., & Yuskavage, A. 2018. “The Effects of IRS Audits on EITC Claimants.” National Tax Journal 71(3): 451-484.

Boning, W.C., Guyton, J., Hodge, R., & Slemrod, J. 2020. “Heard it through the grapevine: The direct and network effects of a tax enforcement field experiment on firms.” Journal of Public Economics 190(3-4): 104261.

Alm, James, Betty R. Jackson, and Michael McKee. “Getting the word out: Enforcement information dissemination and compliance behavior.” Journal of Public Economics 93.3-4 (2009): 392-402.

Alm, James. “What motivates tax compliance?.” Journal of Economic Surveys 33.2 (2019): 353-388.