It has been two years since I resurrected Alvin Hansen’s secular stagnation idea and suggested its relevance to current conditions in the industrial world. Unfortunately experience since that time has tended to confirm the secular stagnation hypothesis. Secular stagnation is a possibility. It is not an inevitability and it can be avoided with strong policy. Unfortunately, the Fed and other policy setters remain committed to traditional paradigms and so are acting in ways that make secular stagnation more likely.

The core idea behind secular stagnation was that the neutral real rate had for a variety of reasons fallen and might well be below zero a substantial part of the time going forward. The inference was that economies might be doomed to oscillate between sluggish growth and growth like that of the 2003-2007 period that rested on an unstable financial foundation.

In more technical economic language secular stagnation is the hypothesis that the IS curve has shifted back and down so that the real interest rate consistent with full employment has declined. More straightforwardly if you see weaker growth despite lower real interest rates that tends to confirm the secular stagnation idea.

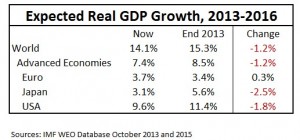

The table below shows what has happened since the Fall of 2013 in the industrial world. Growth has been consistently weaker than was expected. This has occurred even though interest rates have fallen substantially suggesting that it reflects a reduction in demand. Further evidence comes from the decline in inflation expectations. If the dominant shock were slower productivity one might expect to see an increase in inflation. Whatever risk one saw of secular stagnation two years ago, one has to be more concerned today.

Here is a transcript of a lecture (along with the associated power point) given at the Bank of Chile Research Conference that updates my thinking on secular stagnation. A central argument I make is that even in the United States it is unlikely that we have left the zero lower bound behind. Indeed I would judge that there is at least a two-thirds chance that we will experience zero or negative rates again in the next five years.

This pessimism is strongly confirmed by the landmark Rachel and Smith study which shows that there is little basis for believing that neutral real rates will rise in the next few years.

To its credit, judging by the “dots” embodying long run rate projections as well as Chair Yellen’s press conference, the Fed has started to recognize the idea of a declining neutral real rate. Yet I believe its decision to raise rates last week reflected four consequential misjudgments.

First, the Fed assigns a much greater chance that we will reach 2 percent core inflation than is suggested by most available data. Inflation swaps suggest inflation on the Fed’s preferred PCE deflator measure will average only 1 percent over the next 3 years, 1.2 percent over the next 5 years and 1.5 percent over the next 10 years. Survey measures of expected inflation are falling not rising. Moreover, if account is taken of quality change inflation measures would have to be further reduced.

Second, the Fed seems to mistakenly regard 2 percent inflation as a ceiling not a target. One can reasonably argue that after years of below target inflation, it is appropriate to have a period of above target inflation. This is implied by arguments for price level targeting. Alternatively, it seems reasonable to simply suggest that the Fed should run equal risks of over and under shooting its inflation target. I would actually argue given the observed costs of deflation that the costs of under shooting the target exceed the costs of overshooting it.

Third, the Fed seems to be in the thrall of notions that might be right but do not to my knowledge have analytic support premised on the idea that the rate of change of interest rates as distinct from their level influences aggregate demand. It is suggested that by raising rates the Fed gives itself room to lower them. This is tautologically true but I know of no model in which demand will be stronger in say 2018 if rates rise and then fall than if they are kept constant at zero. Nor conditional on their reaching say 3 percent at the end of 2017 do I know of a reason why recession is more likely if the changes are backloaded. I would say the argument that the Fed should raise rates so as to have room to lower them is in the category with the argument that I should starve myself in order to have the pleasure of relieving my hunger pangs.

Fourth, the Fed is likely underestimating secular stagnation. It is failing to recognize its transmission from the rest of the world and it is overestimating the degree of monetary accommodation now present and likely to be present in the future by overestimating the neutral rate. I suspect that if nominal interest rates were 3 percent and inflation were far below target there would be much less pressure to raise them than there has been of late. The desire to raise rates reflects less some rigorous Philips curve analysis than a sense that zero rates are a sign of pathology and an economy creating 200,000 jobs a month is not diseased. The complexity is that zero rates may be less abnormal than is supposed because of fundamental shifts in the saving investment balance,

Why is the Fed making these mistakes if indeed they are mistakes? It is not because its leaders are not thoughtful or open minded or concerned with growth and employment. Rather I suspect it is because of an excessive commitment to existing models and modes of thought. Usually it takes disaster to shatter orthodoxy. We can all hope that either my worries prove misplaced or the Fed shows itself to be less in the thrall of orthodoxy than it has been of late.

Pingback: Tuesday December 22nd; flat overnight

Pingback: LARRY SUMMERS: I think the Fed is making these 4 mistakes right now (DIA, SPX, SPY, QQQ, TLT, IWM) | Send Emails

Pingback: Krugman’s blog, 12/30/15 | Marion in Savannah