On Tuesday, I spoke in Houston at a forum sponsored by the Dallas Federal Reserve. Inevitably given that I was at the Fed, the topic turned to monetary policy. On monetary policy, President Kaplan asked what I thought the Fed should be doing and saying. I suggested four modifications to its current posture.

First, it should acknowledge that the neutral rate is now close to zero and it may well remain under 2 percent for the foreseeable future. With the economy growing at below 2 percent over the last year, total hours of work essentially flat for the last 6 months, and with long term inflation expectations declining there is no reason to think we are currently much below the neutral rate. And given that the neutral rate has been trending downwards since well before the financial crisis we have no basis for being confident that it will not continue declining, and certainly no basis for supposing it will increase.

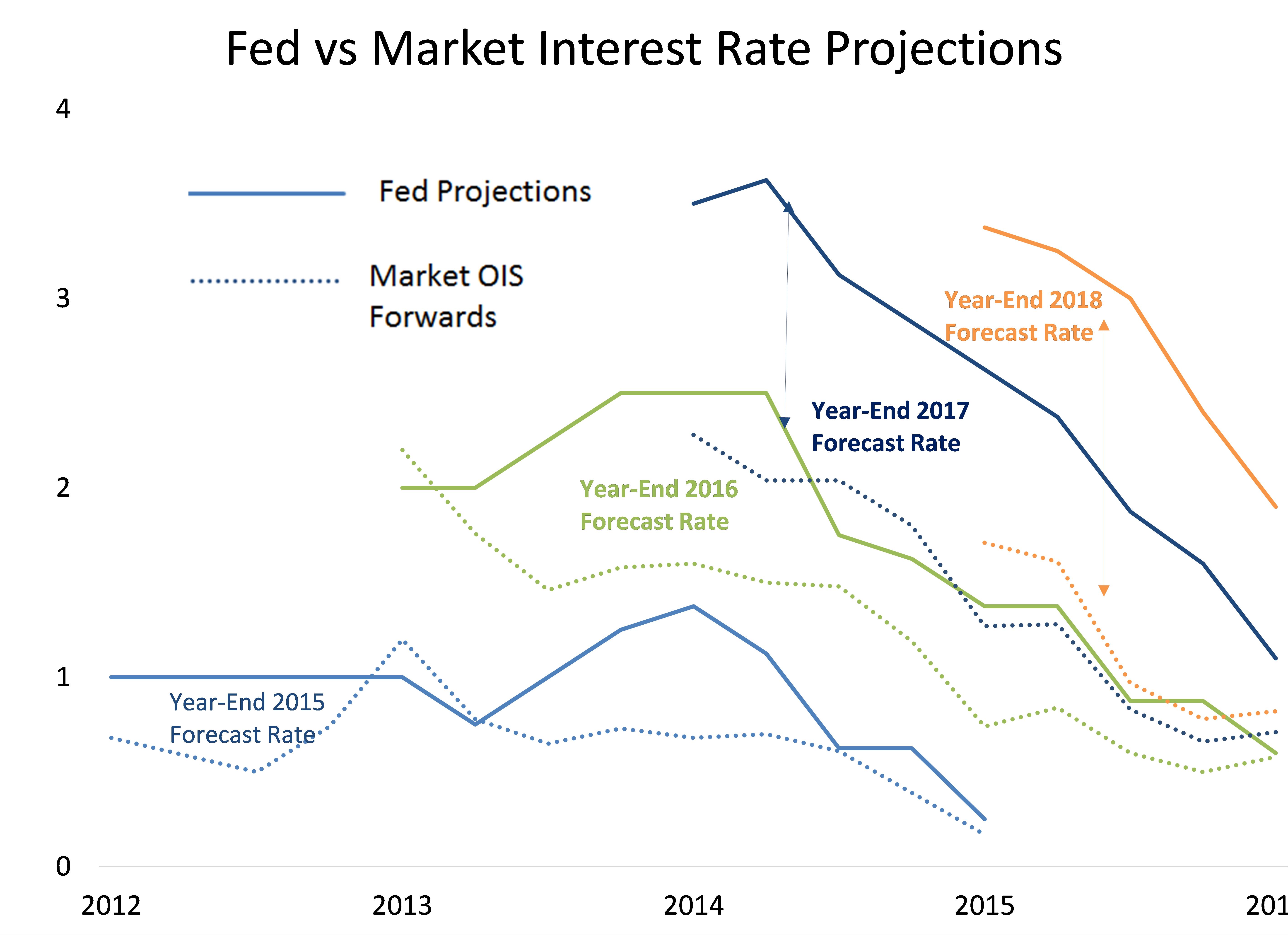

Second, it should acknowledge at least to itself that it has damaged its credibility by repeatedly holding out the prospects of much more tightening than the market anticipated, being ignored by the market, and then having the market turn out to be right. It should recognize output and inflation and unemployment would all be closer to their target levels today and in their forecasts if rates had not been increased last December. It should move to bring its stated plans more in line with external expectations regarding how much tightening the economy can tolerate.

Third, the Fed should make real the idea that its inflation target is symmetric by being clear that in the late stage of prolonged expansion with low unemployment it is comfortable with inflation rising a little bit above 2 percent with the confidence that it will decline when the next recession comes. The Fed does not expect inflation to reach 2 percent until 2018 and the gradient is not steep. So it should be clear that until inflation expectations look to be rising above 2 percent there is no need to restrain the economy.

Fourth, the Fed should make clear that it sees risk as asymmetric right now. If the economy falls into recession there is a real risk of a Japan scenario in which it will be very difficult to combat deflation. On the other hand, there is no great risk if inflation drifts above two percent. It might as I have noted actually be desirable. And if not, policy can be tightened to prevent the economy from overheating as has occurred many times in the past.

Eric Rosengren, in explaining his dissent on the decision not to raise rates in September, argues that the Fed has historically had a hard time tapping the brakes and that if the Fed has to cool off an overheated economy a recession is likely to result. I am not sure what aspect of history he has in mind here. It certainly is true that the Fed has on occasion reacted strongly to inflation in ways that caused a recession. But on each of those occasions inflation was far beyond desired levels and the recession was the price of bringing it back to desired levels. Rosengren’s case would be made by examples where so much extra slack was induced that the economy undershot on inflation. I am not aware of such instances.

Governor Brainard did an excellent job in her recent speech of making the asymmetric risks argument. It is actually a very broad one. A recession would push millions out of work, stunt economic growth, increase inequality, balloon Federal debt and in all likelihood cause our politics to become ever more bitter and toxic. Every prudent precaution to prevent one should be taken.

It takes a tortured argument to believe that you can prevent a car from stopping by hitting the brakes. Much better if you want the car to keep going to keep your foot off the brake until and unless you see imminent danger. This is no time for the Fed to be creating uncertainty by raising the specter of interest rate increases at a time when markets do not expect 2 percent inflation in this decade.