How Washington Should End Its Debt Obsession

By Jason Furman and Lawrence H. Summers

The United States’ annual budget deficit is set to reach nearly $1 trillion this year, more than four percent of GDP and up from $585 billion in 2016. As a result of the continuing shortfall, over the next decade, the national debt—the total amount owed by the U.S. government—is projected to balloon from its current level of 78 percent of GDP to 105 percent of GDP. Such huge amounts of debt are unprecedented for the United States during a time of economic prosperity.

Does it matter? To some economists and policymakers, the trend spells disaster, dragging down economic growth and potentially leading to a full-blown debt crisis before too long. These deficit fundamentalists see the failure of the Simpson-Bowles plan (a 2010 proposal to sharply cut deficits) as a major missed opportunity and argue that policymakers should make tackling the national debt a top priority. On the other side, deficit dismissers say the United States can ignore fiscal constraints entirely given low interest rates (which make borrowing cheap), the eagerness of investors in global capital markets to buy U.S. debt (which makes borrowing easy), and the absence of high inflation (which means the Federal Reserve can keep interest rates low).

The deficit dismissers have a point. Long-term structural declines in interest rates mean that policymakers should reconsider the traditional fiscal approach that has often wrong-headedly limited worthwhile investments in such areas as education, health care, and infrastructure. Yet many remain fixated on cutting spending, especially on entitlement programs such as Social Security and Medicaid. That is a mistake. Politicians and policymakers should focus on urgent social problems, not deficits.

But they shouldn’t ignore fiscal constraints entirely. The deficit fundamentalists are right that the debt cannot be allowed to grow forever. And the government cannot set budget policy without any limiting principles or guides as to what is and what is not possible or desirable.

There is another policy approach that neither prioritizes cutting deficits nor dismisses them. Unlike in the past, budgeters need not make reducing projected deficits a priority. But they should ensure that, except during downturns, when fiscal stimulus is required, new spending and tax cuts do not add to the debt. This middle course would tolerate large and growing deficits without making a major effort to reduce them—at least for the foreseeable future. But it would also stop the policy trend of the last two years, which will otherwise continue to pile up debt.

Policymakers must also recognize that maintaining existing public services, let alone meeting new needs, will, over time, require higher revenues. Today’s large deficits derive more from falling revenues than rising entitlement spending. More spending is not, by itself, something to be afraid of. The United States needs to invest in solutions to its fundamental challenges: finding jobs for the millions of Americans who have given up hope of finding them, providing health insurance for the millions who still lack it, and extending opportunities to the children left behind by an inadequate educational system.

THE TRUTH ABOUT DEFICITS

Economic textbooks teach that government deficits raise interest rates, crowd out private investment, and leave everyone poorer. Cutting deficits, on the other hand, reduces interest rates, spurring productive investment. Those forces may have been important in the late 1980s and early 1990s, when long-term real interest rates (nominal interest rates minus the rate of inflation) averaged around four percent and stock market valuations were much lower than they are today. The deficit reduction efforts of Presidents George H. W. Bush and Bill Clinton contributed to the investment-led boom in the 1990s.

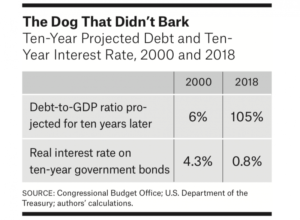

Today, however, the situation is very different. Although government debt as a share of GDP has risen far higher, long-term real interest rates on government debt have fallen much lower. As shown in the table, in 2000, the Congressional Budget Office forecast that by 2010, the U.S. debt-to-GDP ratio would be six percent. The same ten-year forecast in 2018 put the figure for 2028 at 105 percent. Real interest rates on ten-year government bonds, meanwhile, fell from 4.3 percent in 2000 to an average of 0.8 percent last year. Those low rates haven’t been manufactured by the Federal Reserve, nor are they just the result of the financial crisis. They preceded the crisis and appear to be rooted in a set of deeper forces, including lower investment demand, higher savings rates, and widening inequality. Interest rates may well rise a bit over the next several years, but financial markets expect them to end up far below where they stood in the 1980s and 1990s. Federal Reserve Chair Jay Powell has noted that the Fed’s current 2.375 percent interest rate is close to the neutral rate, at which the economy grows at a sustainable pace, and financial markets expect that the federal funds rate will not rise any further.

Low interest rates mean that governments can sustain higher levels of debt, since their financing costs are lower. Although the national debt represents a far larger percentage of GDP than in recent decades, the U.S. government currently pays around the same proportion of GDP in interest on its debt, adjusted for inflation, as it has on average since World War II. The cost of deficits to the Treasury is the degree to which the rate of interest paid on the debt exceeds inflation. By this standard, the resources the United States needs to devote to interest payments are also around their historical average as a share of the economy. Although both real and nominal interest rates are set to rise in the coming decade, interest payments on the debt are projected to remain well below the share reached in the late 1980s and early 1990s, when deficit reduction topped the economic agenda.

Government deficits also seem to be hurting the economy less than they used to. Textbook economic theory holds that high levels of government debt make it more expensive for companies to borrow. But these days, interest rates are low, stock market prices are high relative to company earnings, and major companies hold large amounts of cash on their balance sheets. No one seriously argues that the cost of capital is holding back businesses from investing. Cutting the deficit, then, is unlikely to spur much private investment.

Moreover, the lower interest rates that would result from smaller deficits would not be an unambiguously good thing. Many economists and policymakers, including former Treasury Secretary Robert Rubin and the economist Martin Feldstein, worry that interest rates are already too low. Cheap borrowing, they argue, with some merit, has led investors to put their money in unproductive ventures, created financial bubbles, and left central bankers with less leeway to cut rates in response to the next recession. If the United States cut its deficits by three percent of GDP, enough to stabilize the national debt, interest rates would fall even further.

Some commentators worry that rising deficits don’t just slowly eat away at economic growth, as the textbooks warn; they could lead to a fiscal crisis in which the United States loses access to credit markets, sparking an economic meltdown. There is precious little economic theory or historical evidence to justify this fear. Few, if any, fiscal crises have taken place in countries that borrow in their own currencies and print their own money. In Japan, for example, the national debt has exceeded 100 percent of GDP for almost two decades. But interest rates on long-term government debt remain near zero, and real interest rates are well below zero. Even in Italy, which does not borrow in its own currency or set its own monetary policy and, according to the markets, faces a substantial risk of defaulting, long-term real interest rates are less than two percent, despite high levels of debt and the government’s plans for major new spending.

The eurozone debt crisis at the start of this decade is often held up as a cautionary tale about the perils of fiscal excess. But stagnant growth (made worse by government spending cuts in the face of a recession) was as much the cause of the eurozone’s debt problems as profligate spending. And countries such as those in the eurozone, which borrow in currencies they do not control, face a far higher risk of debt crises than countries such as the United States, which have their own currencies. Countries with their own currencies can always have their central bank buy government debt or print money to repay it; countries without them can’t.

Higher levels of debt do have downsides. They could make it harder for governments to summon the political will to stimulate the economy in a downturn. But saying that a country would be better off with lower debt is not the same as saying that it would be better off lowering its debt. The risks associated with high debt levels are small relative to the harm cutting deficits would do.

It’s true that future generations will have to pay the interest on today’s debt, but at current rates, even a 50-percentage-point increase in the U.S. debt-to-GDP ratio would raise real interest payments as a share of GDP by just 0.5 percentage points. That would bring those payments closer to the top of their historical range, but not into uncharted territory.

Deficits, then, should not cause policymakers much concern, at least for now. But some economists adopt an even more radical view. Advocates of what is known as modern monetary theory (MMT), such as Stephanie Kelton, an economist and former adviser to Senator Bernie Sanders’ presidential campaign, have been widely interpreted as arguing that governments that borrow in their own currencies have no reason to concern themselves with budget constraints. Taxes should be set based not on spending levels but on macroeconomic conditions, and deficit financing has no effect on interest rates. Some politicians have invoked those positions to suggest that the government need not worry about debt at all. (Kelton and other MMT supporters claim that this is a misinterpretation of their theory, but it’s not clear what their true arguments are, and most of the political supporters of MMT have used it as a justification for ignoring government debt entirely.)

This goes too far. When the economy is held back by lack of demand during a downturn, modern monetary theory gives similar answers to those provided by more mainstream Keynesian theory—that is, that more spending or lower taxes will have little effect on interest rates. But the modern monetarist approach is a poor guide to policy in normal economic times, when it would prescribe large tax hikes to control inflation—not exactly the policy its advocates highlight.

In truth, no one knows the benefits and costs of different debt levels—75 percent of GDP, 100 percent of GDP, or even 150 percent of GDP. According to the best projections, the United States is on course to exceed these figures over the next 30 years. Although the U.S. government will remain solvent for the foreseeable future, it would be imprudent to allow the debt-to-GDP ratio to rise forever in an uncertain world. Trying to make this situation sustainable without adjusting fiscal policy or raising interest rates, as recommended by some advocates of modern monetary theory, is a recipe for hyperinflation.

HOW WE GOT HERE

There is a widely held misconception that the deficit has risen primarily because government programs have grown more generous. Not so. Deficits have ballooned because a series of tax cuts have dramatically reduced government revenue below past projections and historical levels. The tax cuts passed by Presidents George W. Bush and Donald Trump totaled three percent of GDP—much more than the projected increases in entitlement spending over the next 30 years. Those cuts meant that in 2018, the federal government took in revenue equivalent to just 16 percent of GDP, the lowest level in half a century, except for a few brief periods in the aftermath of recessions. Without the Bush and Trump tax cuts (and the interest payments on the debt that went with them), last year’s federal budget would have come close to balancing. As things stand, however, the Congressional Budget Office projects that revenue over the next five years will continue to average less than 17 percent of GDP, a percentage point lower than under President Ronald Reagan.

Today’s revenue levels are even lower relative to in the past than these share-of-GDP figures imply. If tax policy is left unchanged, government revenue should rise as a share of GDP. In part, this is because of what economists call “real bracket creep.” Society has decided that it is fair to tax people making, say, $1 million at a higher rate than those making, say, $50,000. Over time, economic growth means more people earn higher incomes, adjusted for inflation, and so more people pay higher tax rates.

More serious than leading to inadequate revenue is the way that tax cuts in the last 25 years have misallocated resources. They have worsened income inequality and, at best, have done very little for economic growth. The most recent tax cut, in 2017, will cost $1.9 trillion over ten years, but it boosted growth only slightly, if at all, while shifting the distribution of income toward the wealthy and reducing the number of people with health insurance.

Look abroad, and it becomes obvious that the United States has more of a revenue problem than an entitlement problem. U.S. spending on social programs ranks among the lowest in 35 advanced economies, yet the country has the highest deficit relative to its GDP in the group. That is because the United States brings in the fifth-lowest total revenue as a share of GDP among those 35 countries.

The idea that higher spending, particularly on entitlements, is to blame for rising deficits stems from a combination of faulty numbers and faulty analysis. Total U.S. government spending, excluding interest payments, amounts to 19 percent of GDP, up only slightly from its average of 18 percent between 1960 and 2000. Social Security and Medicare spending are set to rise by more than this over the coming decades, but that rise will be at least partially offset by other spending reductions and will do less to increase the deficit in terms of present value, which accounts for the current value of future spending and borrowing, than the tax cuts passed in the last two and a half decades.

What’s more, looking at shares of GDP is a bad way to understand the underlying causes of deficits and how they might shrink. Entitlement costs have risen not because the programs have become more generous but largely because the population as a whole has aged, a fact that is mostly the result of falling birthrates. As retirees’ share of the population grows, so does spending on Social Security and Medicare. That is not making government spending more generous to the elderly, and there is no reason why retirees should bear most of the burden of lower birthrates.

One might argue that the rise in entitlement spending caused by longer life spans represents an increase in the generosity of Social Security and Medicare, since people are collecting benefits for a longer period of time. But that is the wrong way to look at it. By 2025, the standard retirement age for Social Security will complete its rise from 65 to 67, reducing the time that most people will collect benefits. Many lower-income Americans, moreover, are dying younger than they used to. That disturbing trend means that poorer retirees are collecting less in Social Security payments than before.

There’s another reason that shares of GDP make for a bad way to measure how much the government does: the things the government buys cost much more in relative terms than they used to. Over the last 30 years, the cost of both a day in a hospital and a year in college has risen by a factor of more than 200 relative to the price of a television set. It’s also getting more expensive for the United States to maintain its global military advantage as potential adversaries, such as China, Iran, and Russia, boost their military spending.

At a more abstract level, rising inequality also pushes up the cost of achieving any given policy goal. Most people acknowledge that the government has some role to play in redistributing income, even though they disagree on how large that role should be. For any given amount of redistribution, more inequality means more spending.

DO NO HARM

Although politicians shouldn’t make the debt their top priority, they also shouldn’t act as if it doesn’t matter at all. Large mismatches between revenue and spending will have to be fixed at some point. All else being equal, it would be better to do so before the amounts involved get out of hand. And since economists aren’t sure just how costly large deficits are, it would be prudent to keep government debt in check in case they turn out to be more harmful than expected.

Even setting aside these macroeconomic considerations, politicians should remember that running budget deficits does not replace the need to raise revenue or cut spending; it merely defers it. Sooner or later, government spending has to be paid for. It is hard to budget rationally and decide what expenditures and tax cuts are worthwhile when one obfuscates the ultimate cost of these policies. Policymakers won’t be able to argue against a poorly designed but well-intentioned spending program or middle-class tax cut without any limiting principles for fiscal policy.

The right budget strategy must balance several competing considerations: it should get as close as possible to the most economically efficient policy while remaining understandable and politically sustainable. The optimal policy from an economic standpoint would be to gradually phase in spending cuts or tax increases at a rate that would prevent perpetual growth in the national debt as a share of the economy but would avoid doing serious harm to economic demand along the way. Such an approach, however, would be complicated and difficult to understand. Nuance doesn’t sell.

A requirement that the federal government balance its budget or begin paying down the debt is easier to grasp but would impose far more deficit reduction than the economy needs or could bear. Such measures are also politically unsustainable. Even if policymakers passed such legislation tomorrow, they could not bind their successors to it. Clinton oversaw four balanced budgets and bequeathed a declining national debt to Bush, but a decade after Clinton left office, the debt was higher than when he arrived.

A simple approach to fiscal policy that would prove understandable, sustainable, and economically reasonable would be to focus on important investments but do no harm. In short, when you are in a hole, stop digging. That means that instead of passing unfunded legislation, Congress should pay for new measures with either spending cuts or extra revenues, except during recessions, when fiscal stimulus will be essential given the increased constraints on monetary policy now. This approach would provide a ready way to prioritize: if something is truly worth doing, it should be worth paying for. Such a course would also strike a reasonable balance between the harms of extra debt and the harms of deficit reduction. The deficit would continue climbing to unprecedented levels. But no longer would the United States be pursuing the reckless fiscal policies of the last two years, which, if continued, would add even more debt, even faster, while driving up inequality and failing to support growth.

A lot of details would need to be worked out. Analysts will have to decide whether to exclude from their deficit calculations certain kinds of spending—such as infrastructure spending—that represent investments rather than current consumption. One critical question is whether analysts will use dynamic scoring, an approach that accounts for how a new policy will affect the economy when calculating what it will cost. Advocates of dynamic scoring argue that it provides more accurate cost estimates, but critics point out that getting the numbers right is tricky, so it’s easy to bake in overly optimistic assumptions and thus get almost any result you want. In truth, dynamic scoring is a useful tool, as long as it’s done right.

Dynamic scoring is usually limited to tax debates. That’s a mistake, as nontax policies can also have significant budgetary effects. A wide range of experts believe that investments in tax enforcement pay off at a rate of $5 or more for every $1 spent. Although official scorekeepers gave only minimal credit to the cost-control measures in the Affordable Care Act, thanks in large part to those measures, cumulative Medicare and Medicaid spending in the decade after the ACA was passed is likely to end up coming in about $1 trillion below forecasts made at the time.

As policymakers set budgets in the coming years, a lot will depend on what interest rates do. Financial markets do not expect the increases in interest rates that budget forecasters have priced in. If the markets prove right, that will strengthen the case against deficit reduction. If, on the other hand, interest rates start to rise well above what even the budget forecasters expect, then, as in the early 1990s, more active efforts to cut the deficit could make sense.

Even if interest rates remain low, however, the do-no-harm approach won’t be sustainable forever. How long the United States will be able maintain its growing national debt will depend on whether deficits come in above or below current projections. Even so, the national debt presents just one of many problems the United States faces—and not the most pressing.

WHAT REALLY MATTERS

Much more pressing are the problems of languishing labor-force participation rates, slow economic growth, persistent poverty, a lack of access to health insurance, and global climate change. Politicians should not let large deficits deter them from addressing these fundamental challenges. A do-no-harm approach would allow large and growing deficits for a long time, but it would put some constraints on the most ambitious political agendas. Progressives have proposed Medicare for all, free college, a federal jobs guarantee, and a massive green infrastructure program. The merits of each of these proposals are up for debate. But each idea responds to a real need that will take resources to address. Some 29 million Americans still do not have health insurance. College is unaffordable for far too many. Millions of working-age Americans have given up even looking for work. Global warming cannot be ignored. Add in the widely shared desire for more investments in education and infrastructure and the likelihood that defense spending will keep rising, and the federal government will clearly have to spend a lot more.

Congress can fund some new programs by trimming lower-priority spending elsewhere. But this will be difficult. Take health care. There is substantial scope to slow the growth of both public and private health spending. But this will require addressing the health-care system as a whole, not just cutting payments or reforming public health programs. That’s because public health-care spending has shrunk relative to private spending in recent years as the government has found more effective ways to reduce payments and improve efficiency.

Beyond entitlements, everyone has a list of favorite examples of wasteful government spending: farm programs, corporate welfare, and so on. But the dirty secret is that these programs are mostly small, so making them more efficient would not save much money. Enacting serious cuts to spending is much more difficult than most people acknowledge.

One program the federal government should not cut is Social Security. The gap in life expectancy between the rich and the poor is growing, and reducing benefits to retirees could exacerbate that trend. Cutting Social Security would also weaken economic demand far more than cutting most other programs would, as its beneficiaries tend to spend the money rather than save it. If policymakers reform Social Security and Medicare, they should do so to make the programs more effective, not to reduce the debt.

The truth is the federal government needs to raise more revenue. Even if the United States made no new investments and cut Social Security benefits enough to eliminate half of the long-term gap between the program’s revenues and its expenditures (an unwise policy), it would save only about one-third of what is needed to keep the debt from growing relative to the economy. That is why the Simpson-Bowles Commission also proposed raising revenue to 21 percent of GDP, a step that would require a $9 trillion tax increase over the next decade.

Congress can raise some extra revenue in ways many Americans would consider fair, such as by imposing higher taxes on the richest households. It should also raise revenue with another round of corporate tax reform. For example, it can make expensing permanent (expensing allows companies to immediately deduct the cost of new investments from their taxable income) while raising corporate tax rates or taxing firms for the carbon they emit. Economists regard such reforms as economically efficient because they make new investments cheaper while taxing windfall gains and past investments. But tapping the top few percent of households and raising corporate taxes won’t be enough. Ultimately, all Americans will have to pay a little more to support the kind of society they say they want.

ENDING THE DEBT DELUSION

The economics of deficits have changed. A better appreciation of the sources and consequences of government debt, and of the options to address it, should lead policymakers away from many of the old deficitand entitlement-focused orthodoxies—but not to wholesale abandonment of fiscal constraints.

Deficit fundamentalists argue that they are championing a noble and underappreciated cause. In some ways, they are; deficit reduction is never a political winner. But if they turn out to be right, economists and policymakers will know soon enough. The financial markets give immediate feedback about the seriousness of the budget deficit. If the debt becomes a problem, interest rates will rise, putting financial and political pressure on policymakers to accomplish what fiscal fundamentalists have long wanted. But even if that happens, it is not likely to cost so much that it would be worth paying a definite cost today to prevent the small chance of a problem in the future.

Policymakers will always know when the market is worried about the deficit. But no alarm bells ring when the government fails to rebuild decaying infrastructure, properly fund preschools, or provide access to health care. The results of that kind of neglect show up only later— but the human cost is often far larger. It’s time for Washington to put away its debt obsession and focus on bigger things.